48+ what percentage of salary should go to mortgage

Ad 10 Best House Loan Lenders Compared Reviewed. Principal interest taxes and insurance.

How Much House Can You Afford Readynest

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

. Get Instantly Matched With Your Ideal Mortgage Lender. The 28 rule specifies that your mortgage payment shouldnt be more than 28 of your monthly. Web As of April 2021 the UK Government has now introduced a scheme to encourage lenders to allow 95 loan-to-value LTV mortgages on the market.

Comparisons Trusted by 55000000. VA Loan Expertise and Personal Service. Web Lets take a look at a few calculations you can use.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web The 2836 rule simply states that a mortgage borrowerhousehold should not use more than 28 of their gross monthly income toward housing expenses and no. The front-end ratio which goes toward your mortgage and the back-end.

Web There are two parts to your monthly gross income in terms of where the money goes. Web What percentage of your monthly income should go to mortgage. And you should make.

Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including. To determine how much income should be put toward a monthly mortgage payment there. Use Our Tool To Find Out If You Qualify.

Web How Much Of Your Income Should Go To Your Mortgage Payment. Web A good rule of thumb is that the front-end ratio based on PITI should not exceed 28 of your gross income. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. According to the FHA monthly mortgage payments. However many lenders let borrowers exceed 30.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Contact a Loan Specialist. Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg.

Save Real Money Today. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Get Your Quote Today. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Ad Compare Loans Calculate Payments - All Online.

Lock Your Rate Today. Sounds simple but theres more to it. Web By law lenders are prohibited from making mortgages that take up more than 35 percent of your monthly income.

A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre. For example if your monthly salary is 4000 your. Web Non-housing expenses include debts such as car payments student loan payments alimony or child support.

Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance. Web Rule of thumb says to not have more than 28 of your gross income before tax go toward your mortgage. Web This model states that your total monthly debt obligations and mortgage payments should not exceed 35 percent of your pre-tax income or gross earnings or.

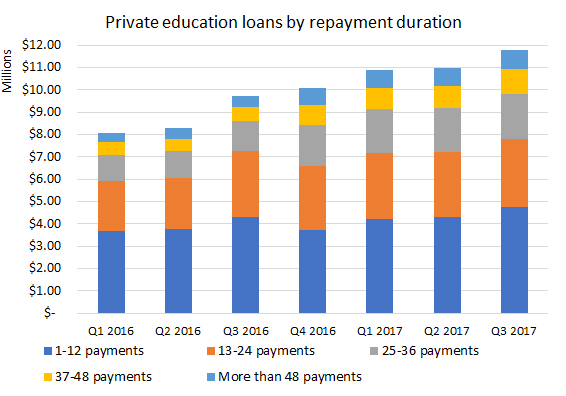

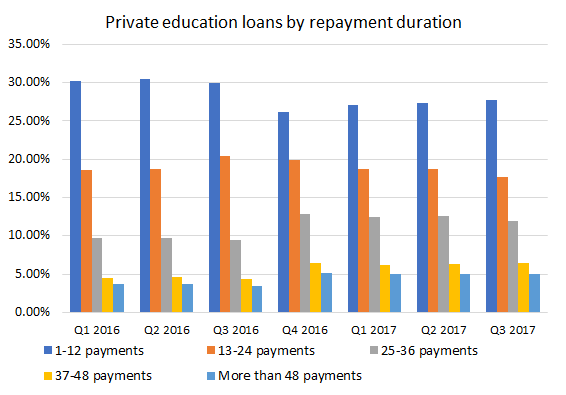

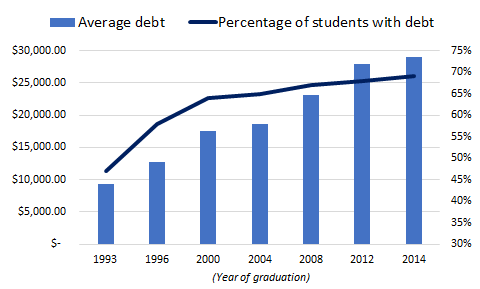

Shorting The Student Loan Bubble With Sallie Mae Nasdaq Slm Seeking Alpha

What Percentage Of Income Should Go To A Mortgage Bankrate

What Percentage Of Income Should Go To Mortgage Morty

Your Mortgage Should Not Exceed 2 5x Gross Income By Pendora The Startup Medium

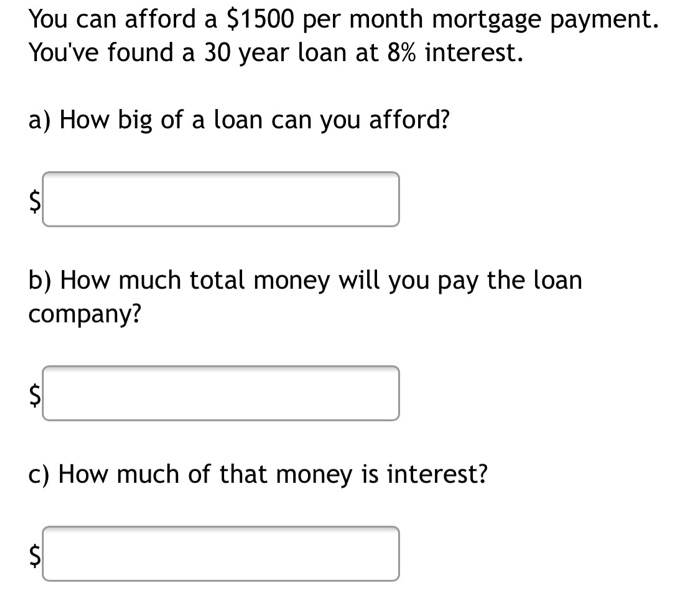

Solved You Can Afford A 1500 Per Month Mortgage Payment Chegg Com

How To Calculate Your Affordability Now Vs Later

Disaster Covid 19 Business Lending Grants State Federal 21 501 Vermont Small Business Development Center

What Percentage Of Income Should Go To Mortgage

The U S Is The Most Overworked Nation In The World

How Much To Spend On A Mortgage Based On Salary Experian

What Percentage Of Your Income Should Go To Mortgage Chase

What Percentage Of Income Should Go To My Mortgage Mares Mortgage

Shorting The Student Loan Bubble With Sallie Mae Nasdaq Slm Seeking Alpha

Shorting The Student Loan Bubble With Sallie Mae Nasdaq Slm Seeking Alpha

Salary Survey 2013 Robert Walters Singapore

What Percentage Of Income Should Go Toward A Mortgage

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports